US regulators close crypto-focused Signature Bank as banking crisis spreads

US regulators have closed down New York-based Signature Bank, a big lender in the country's crypto industry, in a desperate attempt to backstop the banking crisis and quell concerns among customers about the safety of their deposits.

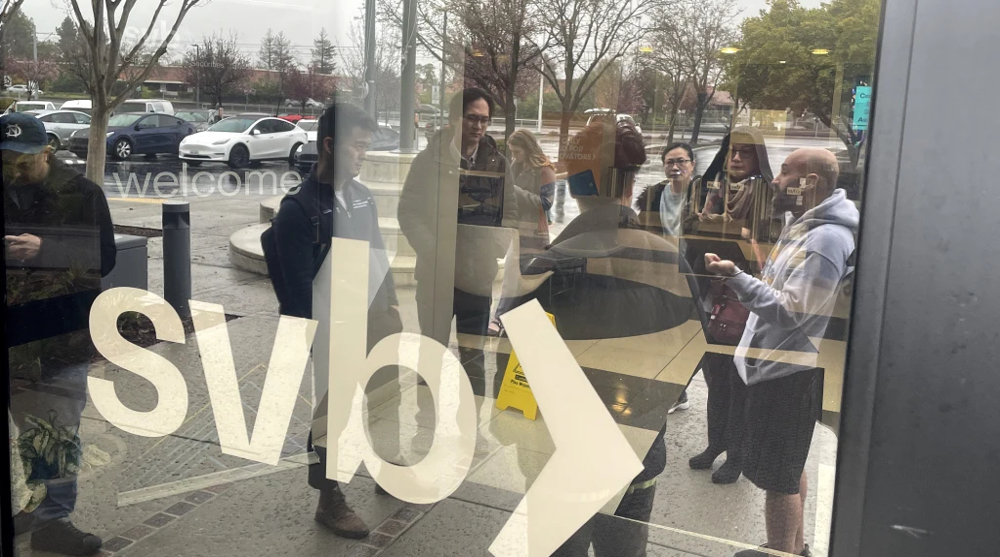

The closure of the bank marks another major failure in US banking history, two days after authorities shuttered Silicon Valley Bank in a collapse that experts say has shaken the foundations of the US economy.

In a joint statement released on Sunday, the US Treasury Department, Federal Reserve, and Federal Deposit Insurance Corporation (FDIC) cited the closure of the New York state-chartered commercial bank with total assets of approximately $110.36 billion and total deposits of approximately $88.59 billion as of December 31, 2022, according to its end of the year statement.

American regulators said keeping open the 24-year-old institution, which held deposits from law firms and real estate companies, could threaten the US financial system’s stability.

All of the depositors of Signature Bank and Silicon Valley Bank (SVB) will be made whole, and "no losses will be borne by the taxpayer," the US Treasury Department and other bank regulators said in the joint statement.

Employees of the bank appeared to gather at the company's Manhattan headquarters on Sunday, according to a reporter on the scene. However, representatives refused to comment on the news of the bank's closure.

"I’m firmly committed to holding those responsible for this mess fully accountable and to continuing our efforts to strengthen oversight and regulation of larger banks so that we are not in this position again," US President Joe Biden tweeted in reaction to Signature Bank’s collapse.

"The American people and American businesses can have confidence that their bank deposits will be there when they need them," he added.

Earlier, US Treasury Secretary Janet Yellen said the government wanted to avoid financial "contagion" from the implosion of the SVB.

In an interview with CBS Sunday, Yellen said the US government wanted "to make sure that the troubles that exist at one bank don't create contagion to others that are sound."

She assured that they were working with the Federal Deposit Insurance Corporation (FDIC), which is the government's deposit guarantee agency, on a "resolution" to the problem.

"I'm sure they (the FDIC) are considering a wide range of available options that include acquisitions," Yellen said.

Virginia Democratic Senator Mark Warner said in an interview with ABC on Sunday that the "best outcome" would be to find a buyer for SVB before markets open in Asia.

Media reported that the New York financial institution Signature Bank was forced into closing its doors abruptly on Sunday after losing its risky bet on cryptocurrency coupled with a run on deposits by investors panicking after SVB’s seizure.

Investors had been frightened by the speed at which startup-focused SVB, the 16th largest lender in the US, was toppled by customer withdrawals, media reported.

SVB’s news last week prompted investors to withdraw more than $100 billion in market value from US banks, prompting swift action from government officials over the weekend to try and restore confidence in the financial system.

Financial analysts linked Signature’s closure to the panic surrounding SVB, which regulators had seized on Friday.

Meanwhile, the New York Department of Financial Services (DFS) took possession of the bank, pursuant to Section 606 of New York Banking Law, in order to protect depositors. The DFS then appointed the FDIC as the receiver of the bank.

The FDIC in turn established a "bridge" successor bank on Sunday which will enable customers to access their funds on Monday. Signature Bank's depositors and borrowers will automatically become customers of the bridge bank, the FDIC said.

Former Fifth Third Bancorp Chief Executive Greg Carmichael was named as CEO of the bridge bank by the regulator.

Signature Bank had private client offices in New York, Connecticut, California, Nevada and North Carolina. It also had nine national business lines including commercial real estate and digital asset banking.

The bank, as of September, had almost a quarter of its deposits coming from the cryptocurrency sector. However, in December it announced that it would shrink its crypto-related deposits by $8 billion.

In February, the bank announced that its chief executive officer, Joseph DePaolo, would transition into a senior adviser role in 2023 and would be succeeded by the bank’s chief operating officer, Eric Howell. DePaolo has served as president and CEO since Signature's inception in 2001.

Links to Trump

Signature Bank and former US president Donald Trump and his family had a long-standing relationship, according to reports. The bank provided Trump and his businesses with checking accounts and financed several of the family's ventures.

However, Signature Bank cut ties with the former US president in 2021 following the deadly Jan. 6 riots on Capitol Hill and urged Trump to resign.

New York Governor Kathy Hochul, in a statement on Sunday, said she hoped the US government would find a solution to provide "increased confidence in the stability of our banking system."

Hochul said the American economy's stability and its growth in the industry, particularly in the field of technology, are dependent upon the availability of banks that can provide facilities with easy terms to new start-up companies.

"Many depositors at these banks are small businesses, including those driving the innovation economy, and their success is key to New York's robust economy," she insisted.

Meanwhile, regulators said on Sunday that senior management of both Signature and SVB banks had been removed and the shareholders and certain unsecured debtholders had no protection against loss.

Officials said any losses to the FDIC's Deposit Insurance Fund used to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Russia threatens to deploy navy to protect vessels from ‘Western piracy’

Iranian Navy chief: Extra-regional fleets in West Asia 'unjustified'

'Die alone or with your family': Lebanese man killed after Israeli call

Iran, Russia to hold joint naval drill in Sea of Oman, Indian Ocean

Macron: French citizens fighting for Israel cannot be 'genociders'

VIDEO | Press TV's news headlines

UN experts say Epstein files reveal crimes against humanity

Iran, Russia sign cooperation document, four MOUs on trade, energy

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website