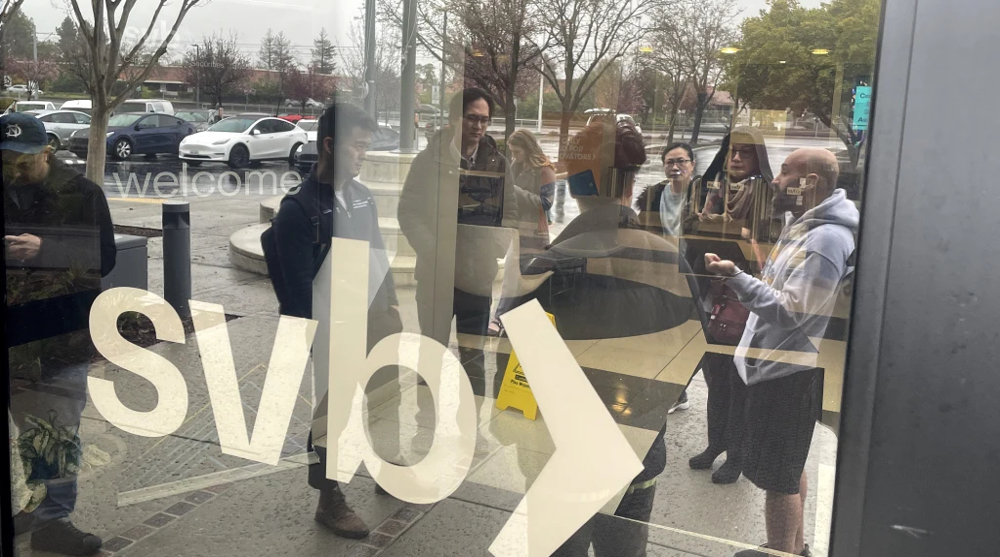

US Silicon Valley Bank collapse could wipe out 'a generation of startups'

The collapse of the US Silicon Valley Bank (SVB), said to be the largest bank failure since the 2008 Washington Mutual financial crisis, has left startups re-questioning their future as the crash sends jolts across the global financial markets.

Silicon Valley Bank failed after depositors hurried to withdraw money over concerns of a liquidity crisis.

Stephanie Ruhle, a senior business analyst with NBC, tweeted that the startup companies are in "deep trouble" following the collapse of Silicon Valley Bank.

“#SVB was one of the biggest providers of “venture debt” to start ups. Often times, as a REQUIREMENT, startups had to keep their main bank account with SVB. Those companies ARE IN DEEP TROUBLE (unless they got all their $ out in the last day),” she said in a tweet.

#SVB was one of the biggest providers of “venture debt” to start ups.

— Stephanie Ruhle (@SRuhle) March 10, 2023

Often times, as a REQUIREMENT, startups had to keep their main bank account with SVB.

Those companies ARE IN DEEP TROUBLE (unless they got all their $ out in the last day).

Shelf Engine, a 40-person startup founded in 2015 that uses artificial intelligence to help grocery stores reduce food waste, had its investor’s money deposited into SVB, just like the billions of dollars belonging to companies and investors that the bank held.

The startup's CEO and co-founder Stefan Kalb had been following news of the SVB and had immediately opened an account at JPMorgan Chase just to attempt to transfer every last penny out of the sinking financial institution.

After making continuous attempts of withdrawing $42 billion from the bank on Thursday, Kalb hoped that the transfer would’ve been successful, but to his nightmare, it was not.

"Unfortunately, our wire was not honored and our money is still at Silicon Valley Bank," Kalb, 37, said in an interview with npr on Friday.

"We woke up this morning hoping the money would be in that JPMorgan bank account, and it was not."

Apart from the US, the bank failure also sent its waves to countries like Israel and the UK.

On Saturday, Israeli venture capital funds held emergency meetings to discuss necessary measures to help Israeli startups that are unable to withdraw money from SVB.

Israeli firms also face tough challenges in paying the salaries of their employees based in the US.

In Britain, the finance ministry and the Bank of England said that they are working together to minimize the disruptions that may arise from the collapse of the UK section of SVB.

"The government recognizes that tech sector companies are often not cash-flow-positive as they grow and that they rely on cash on deposits to cover their day to day costs," the ministry said in a statement, as it raised concerns about the issues faced by the British tech companies.

The Bank of England on Friday said it was seeking a court order to place SVB UK into an insolvency procedure.

More than 250 UK tech firm chief executives signed a letter addressed to Jeremy Hunt, the British chancellor of the exchequer, calling for government intervention, a copy seen by Reuters shows.

"The recent news about SVB going into insolvency represents an existential threat to the UK tech sector," the letter said.

"This weekend the majority of us as tech founders are running numbers to see if we are potentially technically insolvent," it added.

In the wake of the SVB's collapse, Garry Tan, president and CEO of Y Combinator, told CNBC late Friday night that, "over 1,000 YC companies have been affected with a third not being able to make payroll in the next 30 days."

"If the government doesn't step in, I think a whole generation of startups will be wiped off the planet," Tan said in an interview.

Ever since 2022, SVB began to incur steep losses following increased interest rates and a major downturn in growth in the tech industry, where the bank's liabilities were heavily concentrated.

A combination of major factors, including poor risk management and a bank run by tech industry investors, caused the bank to collapse.

"Silicon Valley Bank, Santa Clara, California, was closed today by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver.

To protect insured depositors, the FDIC created the Deposit Insurance National Bank of Santa Clara (DINB). At the time of closing, the FDIC as receiver immediately transferred to the DINB all insured deposits of Silicon Valley Bank," the Federal Deposit Insurance Corporation (FDIC) said in a statement on Friday.

Its customers mainly comprised primary businesses and wealthy individuals in the technology, life science, and private equity capital industries, and was mainly known for the huge risks it took that other banks were afraid of, such as funding startups at their initial stages.

"If you're a high-growth startup, you can't get a credit card from a normal credit card provider, you can't get a loan from a big bank, but Silicon Valley Bank would give you that," Kalb said. "It's these services that startups couldn't get elsewhere."

The bank did business with well-known tech companies including Shopify, Pinterest, Fitbit, and thousands of lesser-known startups, in addition to established venture capital firms, like Andreessen Horowitz.

The meltdown of one of Silicon Valley's cornerstone financial institutions could not have come at a worse time for the startup ecosystem amid high interest rates and market uncertainty, said Tan of Y Combinator.

Russia threatens to deploy navy to protect vessels from ‘Western piracy’

Iranian Navy chief: Extra-regional fleets in West Asia 'unjustified'

'Die alone or with your family': Lebanese man killed after Israeli call

Iran, Russia to hold joint naval drill in Sea of Oman, Indian Ocean

Macron: French citizens fighting for Israel cannot be 'genociders'

VIDEO | Press TV's news headlines

UN experts say Epstein files reveal crimes against humanity

Iran, Russia sign cooperation document, four MOUs on trade, energy

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website