US Wall Street banks stop servicing Russian debt: Report

Two US Wall Street banks are withdrawing from handling trades of Russian debt, as Washington ups the ante in its economic warfare against Moscow over the conflict with Ukraine.

The pullout by JPMorgan Chase and Goldman Sachs comes after Washington announced last week that it was banning US investors from holding such assets.

Citing market professionals, Bloomberg reported on Tuesday that the banks were still matching sellers who wanted out of the debts with interested buyers this month.

Sources said the banks are withdrawing after the US Treasury’s Office of Foreign Assets Control said investors in the United States aren’t allowed to acquire them, sources said.

“Consistent with the updated OFAC guidance and Goldman Sachs’ wind-down of activities in relation to Russia, the firm will no longer be conducting certain client-related market-making activities regarding Russian entities,” Goldman Sachs said in the statement.

The United States has tightened economic sanctions against Russia using the pretext of its conflict with Ukraine. The Treasury Department has banned American money managers from buying any Russian debt or stocks in secondary markets on top of its existing embargo on new-issue purchases.

On May 24, the Treasury Department announced it would no longer allow Russia to make debt payments owed to American bondholders, The Washington Post reported.

Data by one of the world’s largest financial securities transactions companies Euroclear shows that about $85 billion worth of securities held by foreign investors has been blocked.

Russia has denounced America’s decision, describing its actions as a default of the Western financial system, due to its failure to fulfill its financial obligations.

Russia’s Finance Ministry has said Moscow will continue to fulfill its state debt obligations, despite the tightening of external restrictions.

The ban extends to all Russian debt and all Russian firms' shares are affected, not just those ones named in sanctions, according to a statement published on the Treasury’s website on Monday.

A former US sanctions official has said the United States is pushing Russia toward default by blocking debt payments, as Washington ups the ante in its economic warfare against Moscow over the conflict with Ukraine.

Moscow has so far successfully managed to make its international bond payments despite the US-led sanctions that have hindered the process though.

Russia has not defaulted on its external debt for more than 100 years. It has several billions of international bonds and last month made overdue bond payments to avoid default.

Western countries have slapped unprecedented sanctions on Russia since President Vladimir Putin declared a military campaign against Ukraine on February 24.

The Biden administration has imposed harsh economic and banking sanctions on Russia in response to Russia's military actions in Ukraine.

US President Joe Biden said the sanctions would limit Russia's ability to do business in dollars, euros, pounds and yen.

Biden claimed that the only other alternative to the sanctions would be to start a “Third World War.”

The erasure of Palestinian cultural legacy by British Museum

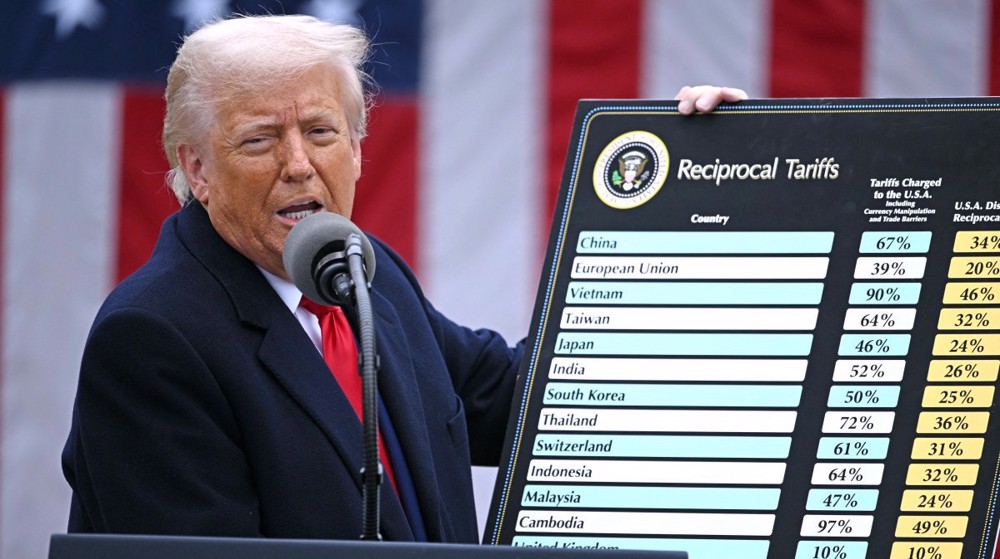

American citizens have borne the ‘lion’s share’ of Trump’s tariff costs: Economist

$50m sportwashing: After turning blind eye to genocide for two years, FIFA funds Gaza stadiums

VIDEO | Trump’s foreign, domestic policies dealt blow after Supreme Court struck down global tariffs

VIDEO | Pakistan launches deadly strikes across border with Afghanistan after attacks

VIDEO | Dublin rally condemns Western-backed genocide in Gaza

Zelensky acting ‘maliciously’ by cutting oil supply: Slovakia’s PM

Iran, other Muslim states slam US envoy’s endorsement of ‘Greater Israel’ plot

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website