Trump’s tariffs on imports backfired, caused job losses and higher prices: Fed study

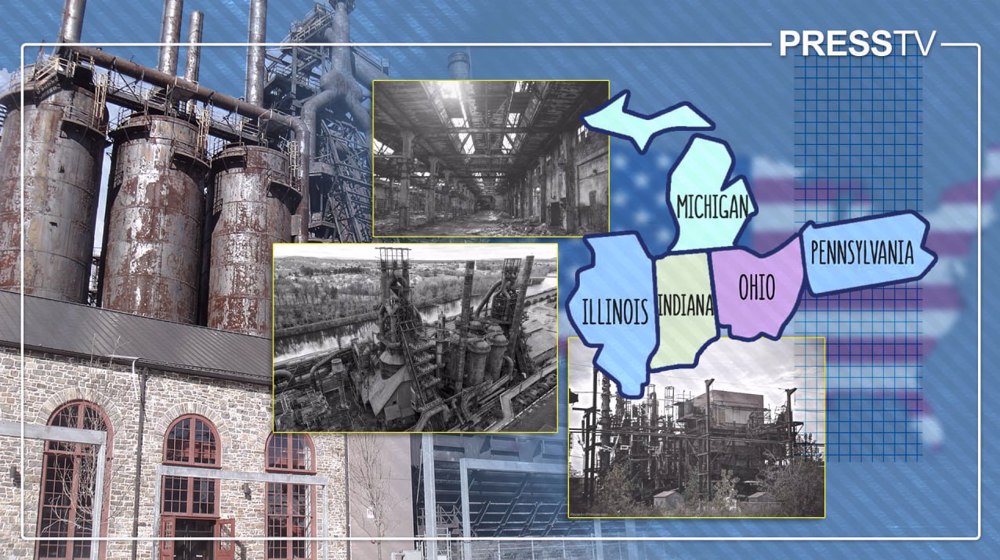

US President Donald Trump's tariffs on imports have backfired, causing job losses and higher prices, a new study by the Federal Reserve has found.

"We find that tariff increases enacted in 2018 are associated with relative reductions in manufacturing employment and relative increases in producer prices," read the report by Fed economists Aaron Flaaen and Justin Pierce, MarketWatch reported on Friday.

The study has found that while the tariffs have reduced competition for some industries in the domestic US market, but this was neutralized by the effects of rising input costs and retaliatory tariffs.

“While the longer-term effects of the tariffs may differ from those that we estimate here, the results indicate that the tariffs, thus far, have not led to increased activity in the U.S. manufacturing sector,” the study said.

The study noted that 10 industries were hit hard by retaliatory tariffs and higher prices, including producers of magnetic and optical media, leather goods, aluminum sheet, iron and steel, motor vehicles, household appliances, sawmills, audio and video equipment, pesticide, and computer equipment.

The Trump administration first imposed steel and aluminum tariffs in March of 2018 from several countries, including Canada, Mexico and Turkey. Trump then declared that "aggressive foreign trade practices" related to the trade goods amounted to an "assault on our country" and the American steel industry.

Then the US president has announced several rounds of tariffs on Chinese goods. Since then, the two countries have exchanged tariffs on more than $360 billion in two-way trade. The US says a primary goal of the aggressive tariff strategy is to decrease the trade imbalance with China, which totaled $379 billion in 2018.

China however had lifted punitive tariffs on American cars and auto parts earlier this year as a goodwill measure while trade talks were underway.

In October, Trump announced a partial deal after meetings in Washington with a Chinese trade delegation.

The deal announced by Trump offered a temporary reprieve from tariffs planned for mid-October.

However, it did not roll back any of the stinging import duties already imposed on hundreds of billions of dollars in trade between the economic powers. Neither did it address another round of import taxes planned for December.

Trump's unresolved trade war with China is seriously damaging the American economy, according to a top economist.

Mark Zandi, chief economist at financial consultancy Moody's Analytics, warned about the trade war's damaging economic impact during an interview last month.

"If you roll this back to a year ago, we were on track to seeing a very strong economy, lower unemployment, wage growth was picking up, particularly at the low end—of course, minimum wage hikes really did help there," Zandi said.

"But then we had the trade war. The trade war has done very serious damage to the economy and, in fact, if the president decides to continue to pursue the trade war, recession risks will rise,” Zandi said.

"I think [Trump] is connecting the dots between the trade war, the economy, and his re-election. He'll probably figure out some way to come to some kind of face-saving arrangement with the Chinese,” he added.

"But if he doesn't, then the economy is really going to struggle and recession risks are going to be very high. We were nearly there. We just got side-tracked by really bad economic policy," he warned.

Lebanon’s parliament speaker urges pressure on Israel to stop ceasefire violations

UK government asked not to release Mandelson emails on Epstein: Report

VIDEO | Gaza Ramadan initiative

Hillary Clinton slams Trump for ‘betraying the West and NATO’

UN Staff group defends Francesca Albanese, condemns European ministers’ ‘vitriolic’ accusations

We will fight to the death for Iranian waters and islands: IRGC commander

Sheikh Qassem: Hezbollah does not seek war, but will never surrender

Hamas slams Israel's plan to expand East al-Quds boundaries

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website