Brits cut spending as living costs soar; EU faces 'new era' of high inflation

Amid reports that consumer confidence is touching an all-time low in the UK, the French finance minister has predicted “a new era of higher inflation” for France and partner countries.

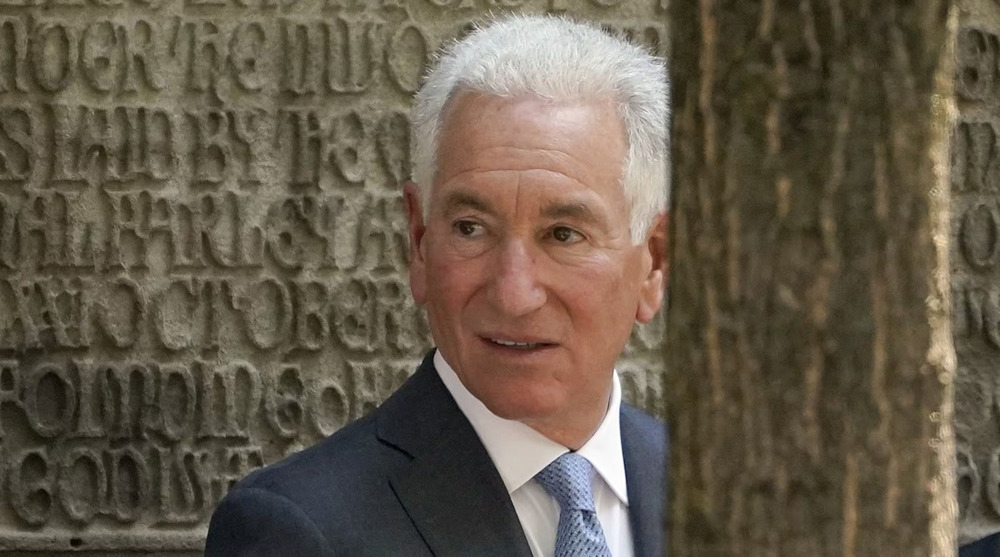

Bruno Le Maire was quoted as saying by BFM TV on Friday that inflation will be high in 2022 in the European country and will remain unchanged until next year.

“I think by 2023, inflation will decline progressively as we manage to balance offer and demand in the energy sector, but we have to be lucid about this: We are entering a new era of higher inflation,” he said.

The headline French inflation figure stood at 5.1% in March, while eurozone inflation in March was marginally lower than earlier reported but still at record highs because of a surge in the cost of energy.

Le Maire noted that the current inflation in the euro zone’s second-biggest economy was driven to the factor of nearly 60 percent by energy prices.

Russia’s military operation in Ukraine has contributed heavily to the sharp surge of energy prices across Europe, in turn exacerbating inflationary pressures in the global economy.

The top French diplomat’s remarks came amid reports that British consumers are beginning to realize the pinch of higher cost-of-living rates with rapidly declining retail sales and consumer confidence approaching an all-time low, as per official figures.

Rising costs bite in UK

Retail sales volumes dropped by 1.4 percent in March from February, a worse reading than any economist forecast that pointed to a 0.3-percent monthly drop, according to UK’s Office for National Statistics (ONS).

The ONS added that food and petrol sales also declined sharply in the month, citing rising prices as possible explanations for the fall. Online retail sales also slipped.

Earlier in the day, market research firm GfK further announce that consumer confidence dropped this month close to its lowest level since records began being kept nearly 50 years ago.

GfK's gauge of consumers' confidence about their finances in the future also slumped to a record low.

Overall, according to reports, the data pointed to growing concerns at the Bank of England (BoE) about opposing challenges of weakening demand and inflation at a 30-year high of seven percent and likely to climb further beyond the central bank's 2% target.

This is while Governor Andrew Bailey announced on Thursday that the BoE was walking a tight rope between tackling inflation and avoiding recession, a key challenge confronting other major central banks around the globe.

"The sharp decline in sales in March suggests that households are already paring back spending to cope with higher costs for food and fuel," economist Bethany Beckett of Capital Economics was quoted as saying in a BBC report.

"That is only likely to worsen in the coming months as the cost of living crisis intensifies," he further warned.

According to reports, the British pound also fell below $1.30 for the first time since November 2020 after the data.

Earlier this month, Britain's largest retailer, Tesco, warned of a drop in profits as high inflation squeezes the supermarket group and its customers.

A closely watched business survey from S&P Global, due to be released later in the day, will provide more clues on whether the collapse in consumer confidence is harming business activity.

Iranian nation resolved to make criminals pay for blood of martyrs: Shiraz Jews

Iran slams US-Israeli attack on Tehran's 12,000-seat Azadi sports complex as war crime

Death toll from US-Israeli aggression against Iran crosses 1,200

Iran won't stop its retaliation until the aggressor is punished: Speaker Ghalibaf

Iranian armed forces deny launching drone strike toward Azerbaijan

IRGC strikes critical Israeli military sites with Khorramshahr-4 missiles in latest wave

US F-15E Strike Eagle multi-role attack fighter jet downed by IRGC air defenses

Iran won't target its neighbors, but US bases across region: FM spox

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website