Oil prices steady after US call for more oil raises supply concerns

Oil prices remained steady on Thursday following two days of gains after a call by the US for major producers to increase output reinforced supply concerns.

They were also boosted by a pullback in US dollar that can send speculative investors into greenback-denominated assets like commodities.

On Thursday, Brent crude futures edged higher by 8 cents to $71.52 a barrel by 0502 GMT while US West Texas Intermediate (WTI) crude futures gained by 5 cents to $69.30.

"Oil prices rebounded for a third day as President Joe Biden's infrastructure plan boosted reflation hopes, underpinning the energy demand outlook," said Margaret Yang, a strategist at DailyFX.

On Tuesday, the US Senate passed a $1 trillion infrastructure bill which aims to expand transportation systems and is likely result in a number of energy-consuming construction projects.

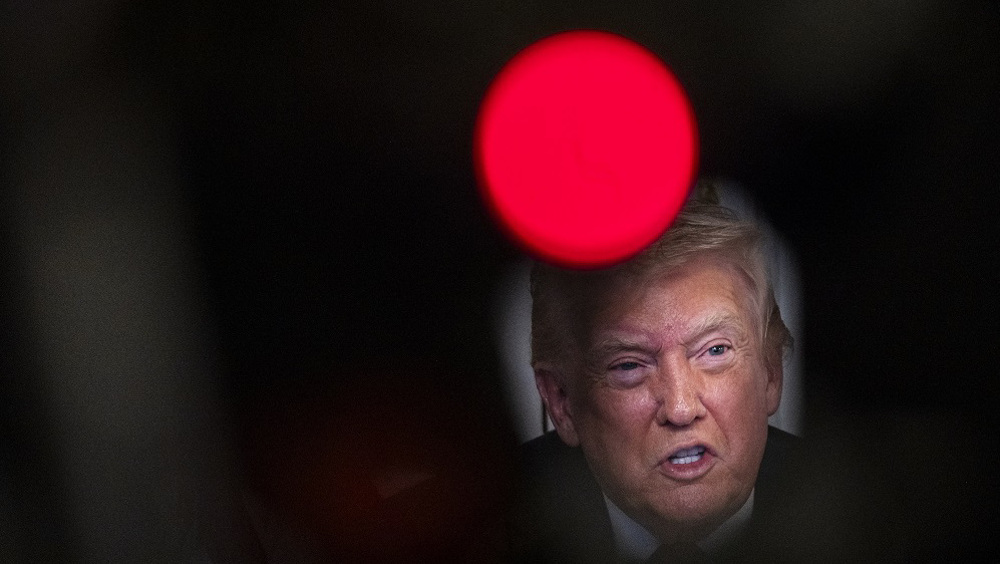

President Joe Biden Wednesday called on the Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+ to boost production in a bid to curb rising gasoline prices his administration says “risk harming the ongoing global recovery”.

The White House argues that an agreement reached by OPEC members last month to boost production on a monthly basis is “simply not enough.”

In July, OPEC agreed to boost output each month by 400,000 bpd over the previous month, beginning in August, until the rest of their record cuts of 10 million bpd, nearly 10% of world demand, made in 2020 are phased out.

However, the increase might not be enough to satisfy demand as the US and Europe ease their coronavirus-related restrictions.

Jake Sullivan, the national security adviser, said the additional output would “not fully offset previous production cuts that OPEC+ imposed during the pandemic until well into 2022.”

“We are engaging with relevant OPEC+ members on the importance of competitive markets in setting prices,” Sullivan said in a statement on Wednesday. “Competitive energy markets will ensure reliable and stable energy supplies, and OPEC+ must do more to support the recovery.”

According to the latest data from the Energy Information Administration (EIA), US production averaged 11.2 million bpd in May, down from the pre-pandemic high above 13 million.

Other data from the EIA report showed that US crude oil stockpiles dropped modestly last week, out of step with forecasts, while gasoline inventories decreased to their lowest level since November. More volatile weekly demand numbers also fell.

Meanwhile, US petrol prices have increased alongside rising motor fuel demand as the economy has reopened from lockdowns. Petrol was selling $3.19 a gallon on average, up almost 50 percent from the same period last year. The highest recorded national average price was over $4.10 a gallon, in 2008.

Israeli airstrikes hit southern Lebanon amid ongoing ceasefire violations

Fourteen Palestinians, including kids, die in Gaza amid freezing temperatures

Putin’s visit to India reinforces Moscow-Delhi ties amid US sanctions, pressures

Discover Iran: Ashuradeh, Iran's only Caspian Sea island and sanctuary for birds, wildlife

VIDEO | Top documentarians gather for 19th Cinema Verite in Tehran

Press TV's news headlines

VIDEO | Karachi hosts Iran trade exhibition to boost economic ties

VIDEO | 'War with Damascus inevitable': Syrians slam Israeli minister’s war statement

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website