US goods trade deficit widens, pending home sales slump

The US goods trade deficit increased sharply in December as imports rebounded, and businesses turned more cautious on accumulating inventory, prompting some economists to lower their economic growth estimates for the fourth quarter.

There was also some discouraging news on the housing market on Wednesday, with contracts to purchase previously owned homes dropping by the most in more than 9-1/2 years in December. The housing market has been regaining momentum after slumping in 2018 and the first half of 2019, thanks to lower mortgage rates.

The Federal Reserve cut interest rates three times last year. Officials from the US central bank were due to wrap up a two-day meeting later on Wednesday. They are expected to reiterate the Fed's desire to keep rates unchanged at least through this year.

The Commerce Department said the goods trade gap surged 8.5% to $68.3 billion last month. The goods trade deficit had dropped for three straight months, driven by declining imports.

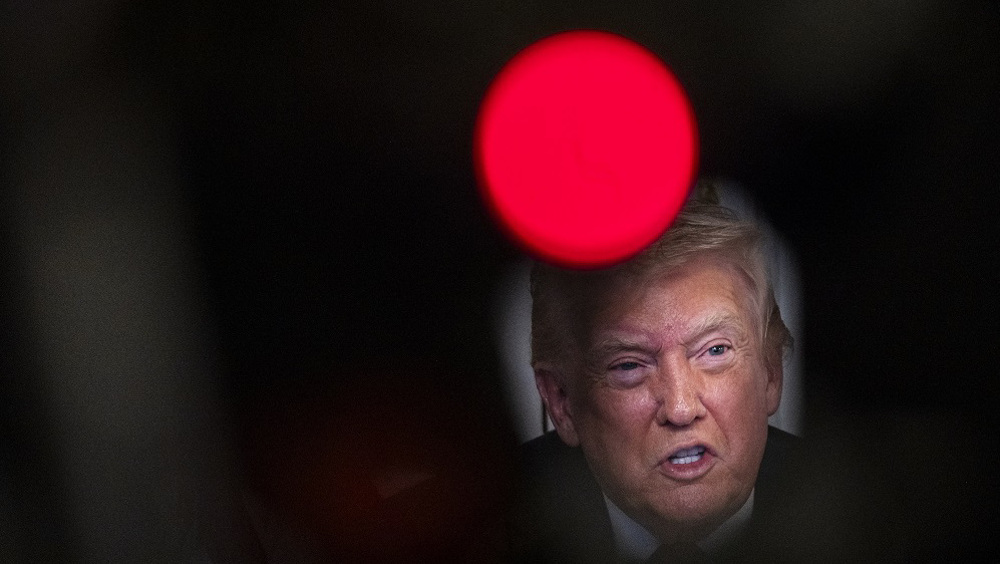

The overall trade deficit is on track to record its first annual decline since 2013. Economists say the Trump administration's "America First" agenda, underscored by an 18-month trade war with China, has restricted the flow of goods, particularly imports.

Though Washington and Beijing signed a Phase 1 trade deal this month, US duties remained in effect on $360 billion of Chinese imports, about two-thirds of the total.

"Despite a Phase 1 US-China deal, existing tariffs, easing US demand and slow global growth will keep trade sluggish," said James Watson, a senior US economist at Oxford Economics in New York.

In December, goods imports surged 2.9% to $205.3 billion after decreasing 1.3% in November. Imports were boosted by industrial supplies, food, consumer and capital goods. Motor vehicle and parts imports, however, fell last month.

Exports of goods rose 0.3% last month to $137.0 billion after increasing 0.8% in November. There were increases in exports of industrial supplies and capital goods. Exports of consumer goods and motor vehicles and parts dropped. Food exports were unchanged last month.

US financial markets were little moved by the data ahead of the Fed's rate decision.

Q4 growth estimates cut

The sharp widening in the goods trade deficit last month suggests the expected boost to fourth-quarter gross domestic product from trade could be a bit more moderate than initially expected. Still, the overall goods trade deficit was probably smaller in the fourth quarter relative to the July-September period. A smaller trade gap is positive for the calculation of GDP.

Trade subtracted 0.14 percentage point from GDP growth in the third quarter. The Atlanta Fed lowered its fourth quarter GDP estimate to a 1.7% pace from a 1.9% rate. JPMorgan cut its fourth-quarter GDP estimate by three-tenths of a percentage point to a 1.4% rate.

The economy grew at a 2.1% annualized rate in the July-September quarter. The government will publish its snapshot of fourth-quarter GDP on Thursday.

"It looks like the contribution to fourth-quarter GDP growth coming from trade will be more modest than we had previously anticipated," said Daniel Silver, an economist at JPMorgan in New York. "Details of the trade report related to the domestic absorption of capex point to equipment spending coming in a little weaker than we had estimated."

The anticipated trade lift to GDP growth could be offset by a smaller pace of inventory accumulation relative to the third quarter. The Commerce Department also reported on Wednesday that retail inventories were unchanged in December after declining 0.8% in the prior month. Motor vehicle and parts inventories were also flat after falling 1.8% in November.

Retail inventories, excluding motor vehicles and parts, the component that goes into the calculation of GDP, were also unchanged after decreasing 0.3% in November.

Wholesale inventories dipped 0.1% last month after gaining 0.1% in November. Inventory investment had a neutral impact on GDP growth in the third quarter.

A separate report on Wednesday from the National Association of Realtors showed its pending home sales index declined 4.9% in December, the biggest drop since May 2010, likely because of a shortage of houses on the market. Compared with one year ago, pending sales were up 4.6%.

Pending home contracts become sales after a month or two, and last month's decline suggests a slowdown in existing home sales, which raced to a near two-year high in December. Still, demand for homes remains strong. Another report from the Mortgage Bankers Association showed applications for loans to purchase a home increased 5% last week from the week before.

Cheaper borrowing costs are being offset by tight inventory, especially in the lower-priced segment of the market, because of land and labor shortages. There were a record-low 1.40 million previously owned homes on the market in December.

(Source: Reuters)

VIDEO | Sana’a university protest condemns Qur’an desecration in texas

Israeli soldier takes own life at military base as Gaza war trauma deepens

Doctors in England begin 5-day strike over pay standoff amid flu surge

VIDEO | Austria keeps activist in jail for pro-Palestine slogan

VIDEO | Iran lab technology cements role in national development

VIDEO | Iran boosts production, export of petroleum products

VIDEO | Nano Iran: Science to impact

Iran says Russia partnership has entered new phase with 3-year cooperation roadmap

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website