Trump's proposed US tax overhaul benefits wealthy, stirs concerns on budget deficit

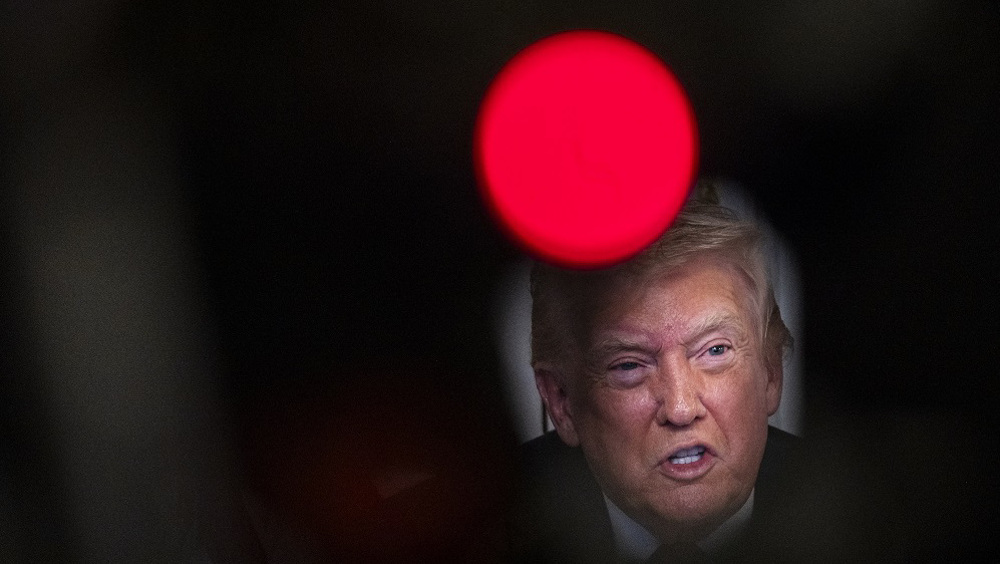

US President Donald Trump has proposed the biggest US tax overhaul in three decades, prompting criticism that the plan benefits corporations and the wealthy and could add trillions of dollars to the budget deficit.

At an event in Indianapolis, Indiana, on Wednesday, Trump called the plan the largest tax cut in US history. He said his tax proposal was aimed at helping working people, creating jobs and making the tax code simpler and fairer.

“We want tax reform that is pro-growth, pro-jobs, pro-worker, pro-family and, yes, tax reform that is pro-American,” The Republican president said.

The plan would lower the top individual tax rate, paid by high-earning American individuals, to 35 percent from 39.6 percent. It would also lower the top corporate income tax rate to 20 percent from the current 35 percent.

Trump’s proposal echoes the large tax cuts that former President Ronald Reagan, in 1981, and former President George W. Bush, in 2001, passed in the first year of their terms.

The plan still must be turned into legislation, but analysts were skeptical that Congress could approve a tax bill this year. A comprehensive rewrite of the American tax code has eluded previous administrations and Congress for decades. The last one was passed in 1986 under Reagan.

Trump has appealed to Democrats to back the plan, although they were not consulted in drafting it. But Democrats said the plan would expand the budget deficit in order to provide tax cuts to wealthy Americans rather than the middle-class families that Trump and Republicans say they are trying to help.

“The tax plan that the Trump administration outlined on Wednesday is a potentially huge windfall for the wealthiest Americans. It would not directly benefit the bottom third of the population. As for the middle class, the benefits appear to be modest,” The New York Times reported in a news analysis.

Analysts have also warned that huge tax cuts would increase the deficit if economic growth projected by Republicans to offset the costs fails to materialize amid rising interest rates.

The proposal drew a swift, skeptical response from some members of Trump’s own Republican Party. Senator Bob Corker, a leading Republican “fiscal hawk” from Tennessee, vowed not to vote for any federal tax package financed with borrowed money.

“What I can tell you is that I’m not about to vote for any bill that increases our deficit, period,” Corker told reporters on Tuesday.

The federal income tax is the centerpiece of a longstanding bipartisan consensus that wealthy Americans should pay an outsize share of the cost of government. But Trump’s plan would continue a long-term march away from progressive taxation.

Successive rounds of federal tax cuts have eroded progressive taxation, according to research by the economists Thomas Piketty of the Paris School of Economics and Emmanuel Saez of the University of California at Berkeley.

The Trump administration argues that its tax cut will lead to such an economic boom that money will flow into the federal coffers and the debt will not rise. The Reagan and Bush administrations made similar claims but the debt soared in both instances.

A study of a 2003 cut in the tax rate on corporate dividends found that lower tax rates do not encourage corporate investment.

Iran’s solar power production up 62% y/y in Apr-Dec

VIDEO | Press TV's news headlines

VIDEO | Gaza through Tunisian eyes: Art as resistance in Tunisia

Palestinian detainee dies in Israeli jail due to medical negligence, torture: Rights groups

‘Organized network’ carried out Daesh‑like attacks in Iranian cities: Security chief

VIDEO | Ethiopia’s PM launches construction of Africa’s largest airport

VIDEO | Italians protesters condemn US aggression against Venezuela

Palestinian baby freezes to death as winter hits displaced Gazans

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website