Commercial banks owe $15.5 bn to Iran’s central bank: Report

Iranian commercial banks and financial institutions owe the central bank of the country a total of $15.5 billion, according to a report which disputes government claims it has managed to reduce borrowing from its coffers by nearly a third.

The report published on Sunday by the semi-official Fars news agency said total debt created by borrowing of banks from the Central Bank of Iran (CBI) had reached 2,085 trillion rial.

It said the figure included borrowing from the CBI by state-run and private banks and other financial institutions, adding that overdraft fines and other costs had been included in the figure.

A recent statement by Iranian President Hassan Rouhani showed that the total debt of the Iranian banks as a result of borrowing from the CBI had been reduced from more than $11 billion to $8.2 billion.

The report by Fars, which was based on data provided by the CBI and calculations made by the Iranian parliament, disputed figures provided by Rouhani, saying they had ignored the fines on overdrafts and other costs incurred by the banks.

The report comes days after the CBI announced it was launching open market operation (OMO) policies to better control the borrowing market between the banks.

The launch of the policy, a first in Iran’s banking history, is ultimately aimed at enabling the CBI to regulate the interest rate in the country.

The CBI launched its first round of OMO measures on Saturday by purchasing sukuk bonds issued by the government and owned by commercial banks.

It did not elaborate on any figure for the first trade but said a next round of purchase of the bonds under OMO will take place on Wednesday.

VIDEO | Press TV's news headlines

VIDEO | ECOWAS leaders vow united front against coups

VIDEO | BDS protest targets French retailer Carrefour in Granada

Iran: Israel's backers complicit in Gaza genocide

US issues warning to Netanyahu over Gaza ceasefire violation: Report

ICC rejects Israel's appeal to invalidate Netanyahu's arrest warrant

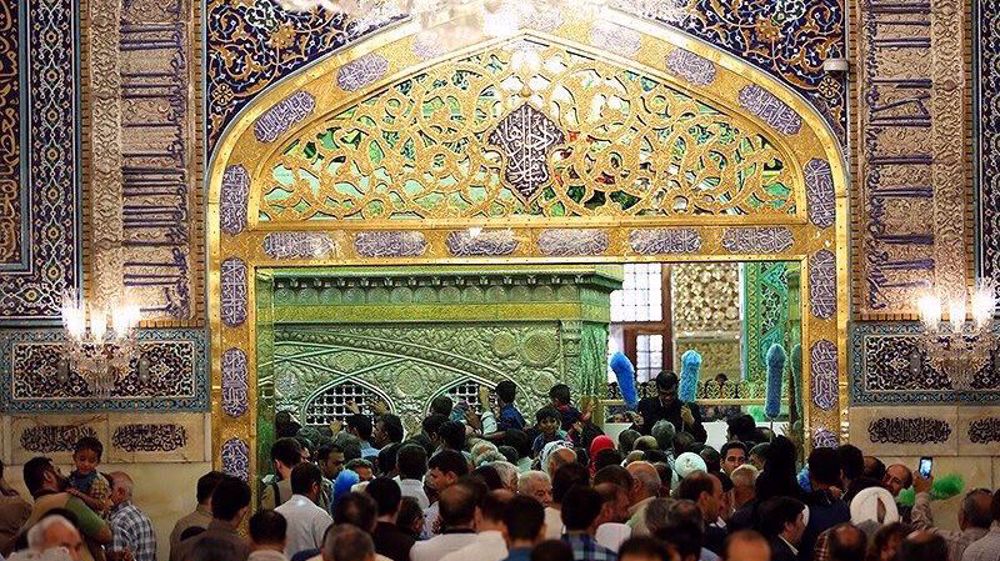

Imam Reza (AS) holy shrine begins accepting crypto donations

VIDEO | Newborn deaths surge in Gaza amid siege and maternal malnutrition

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website