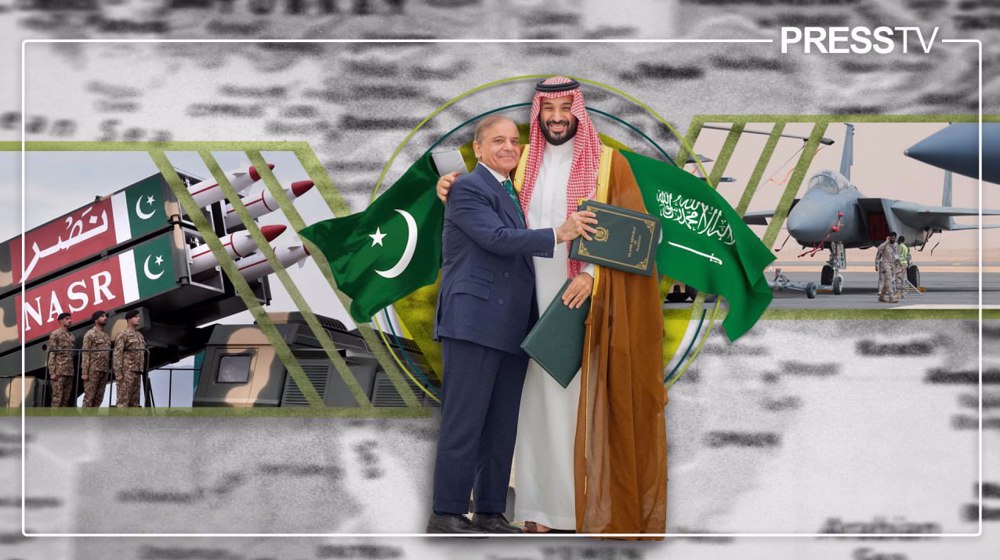

Saudi-Pakistan defense pact: Reshaping security architecture in West and South Asia

By Mohammad Molaei

In the intricate web of West Asian and South Asian geopolitics, where alliances often hinge on the precarious balance of power, energy dependencies, and ideological affinities, the signing of the strategic defense pact between Pakistan and Saudi Arabia marks a pivotal evolution.

This pact represents a calculated maneuver to fortify the alignment of defenses between the two Muslim-majority countries amid waning US commitments. Drawing from operational analyses of similar pacts, like the US-Japan security treaty or the erstwhile CENTO framework, this agreement integrates conventional military interoperability with implicit extended deterrence, potentially altering the calculus of regional power projection.

At its core, the agreement formalizes a mutual defense commitment, stipulating that an armed attack on either party constitutes an assault on both, triggering joint responses under Article 51 of the UN Charter for collective self-defense.

This language echoes NATO's Article 5 but is tailored to the Persian Gulf's hybrid threats, encompassing not just conventional invasions but also proxy warfare, cyber intrusions, and ballistic missile salvos. The pact builds on a 1982 protocol that already facilitated Pakistani troop deployments to Saudi Arabia—historically involving up to 20,000 personnel in advisory and training roles—but elevates it to a comprehensive framework for integrated operations.

Militarily, the agreement spans a spectrum of cooperation modalities. Joint exercises will intensify, drawing from existing bilateral drills like the Al-Samsam series, which have honed mechanized infantry maneuvers and anti-tank warfare using platforms such as Pakistan's Al-Khalid main battle tanks (MBTs) and Saudi M1A2 Abrams variants.

Technology transfers are a cornerstone. Pakistan, with its robust defense-industrial base—including the production of JF-17 Thunder multirole fighters co-developed with China—will share expertise in low-cost unmanned aerial vehicles (UAVs) like the Burraq, equipped with laser-guided munitions for precision strikes.

In return, Saudi Arabia's petrodollar-fueled arsenal offers access to advanced air defense systems, such as the THAAD (Terminal High Altitude Area Defense) interceptors, potentially integrating with Pakistan's HQ-9/P (export variant of China's FD-2000) to create layered anti-ballistic missile shields.

Arms procurement and co-production feature prominently, with provisions for joint ventures in missile technology—leveraging Pakistan's Shaheen-III intermediate-range ballistic missiles (IRBMs) with a 2,750 km reach—and electronic warfare (EW) suites.

Intelligence sharing via secure datalinks will enhance situational awareness, focusing on various threats. Logistically, the pact enables forward basing: Pakistani Special Forces could embed with Saudi Rapid Intervention Forces for counterterrorism operations, while shared maintenance facilities for F-15SA Eagles and AH-64E Apache helicopters streamline sustainment in prolonged conflicts.

Saudi Arabia and Pakistan have agreed to a defense pact: if either is attacked, it will be seen as an attack on both.

— Press TV 🔻 (@PressTV) September 17, 2025

Follow: https://t.co/mLGcUTS2ei pic.twitter.com/VaqhKERLBh

This blueprint for operational synergy mirrors how the Persian Gulf Cooperation Council (PGCC) integrates air assets under Peninsula Shield Force, but with Pakistan's battle-hardened infantry adding asymmetric depth.

Saudi Arabia's pursuit of this pact stems from a pragmatic recalibration of its security posture, driven by the kingdom's Vision 2030 imperatives to reduce oil dependency. Riyadh views Pakistan as a Muslim-majority regional powerhouse with a professional army of over 650,000 active personnel, battle-tested in counterinsurgency campaigns against the Tehrik-i-Taliban Pakistan (TTP) and capable of rapid deployment via C-130J Super Hercules transports.

The kingdom's goals are multifaceted: first, to hedge against US retrenchment, as evidenced by Washington's equivocal responses to the 2019 Abqaiq attacks, which exposed vulnerabilities in Saudi Patriot PAC-3 batteries despite their 90 percent intercept rates against subsonic threats.

Second, the pact bolsters deterrence against Iran's symmetrical arsenal, including medium-range ballistic missiles and tactical ballistic missiles, which have ranges covering the Arabian Peninsula. By aligning with Pakistan, Saudi Arabia gains indirect access to a nuclear-capable partner, complementing its own nascent uranium enrichment program under IAEA safeguards.

Economically, it secures preferential access to Pakistani manpower—over 2 million expatriates already remit billions annually—while channeling investments into Pakistan's defense sector, such as upgrading the Heavy Industries Taxila (HIT) for co-producing Al-Zarrar tanks.

A critical flashpoint is whether the pact extends Pakistan's nuclear umbrella to Saudi Arabia. Pakistan possesses an estimated 170 warheads, deliverable via Ghauri MRBMs (1,500 km range) or Ra'ad ALCMs (air-launched cruise missiles) from F-16C/D platforms, adhering to a "minimum credible deterrence" doctrine focused on India but adaptable to West Asian contingencies.

The agreement's text maintains strategic ambiguity—no explicit mention of nuclear sharing—but statements from Pakistani government officials suggest availability "if needed," implying extended deterrence similar to US commitments to NATO allies.

Analyses indicate this isn't a formal nuclear-sharing arrangement like NATO's B61 gravity bombs in Europe; rather, it's a de facto assurance where Pakistani assets could be forward-deployed in extremis, perhaps via submarine-launched Babur-3 SLCMs from Agosta 90B-class boats.

Saudi funding has historically supported Pakistan's program, per declassified US cables, but proliferation risks loom under the NPT, which Pakistan hasn't signed. The pact stops short of a binding nuclear clause to avoid IAEA scrutiny, opting instead for "all necessary means" language that preserves deniability.

Iranian, Saudi FMs discuss bilateral ties, new defense pact with Pakistan https://t.co/nhuDQMAwAP

— Press TV 🔻 (@PressTV) September 19, 2025

The pact's ramifications cascade across the region, amplifying fault lines and complicating the Persian Gulf's A2/AD dynamics. For the broader West Asia, it fortifies a new bloc, potentially integrating with the UAE's Edge Group UAVs or Bahrain's naval patrols under the Combined Maritime Forces (CMF). This could escalate proxy conflicts in Yemen, where Saudi-led coalitions already employ Pakistani advisors, or in Syria, straining Russian-mediated de-escalation zones.

However, the agreement does not pose any threat to the Islamic Republic, given Pakistan's role as Iran's most important security partner, underscored by recent bilateral agreements on border security, counterterrorism, and economic cooperation, including efforts to combat smuggling and joint patrols.

Iran has welcomed the pact as a step toward "comprehensive cooperation among Muslim nations," reflecting shared interests in regional stability through frameworks like the SCO.

Islamabad's clarification that the agreement is "defensive and not aimed at third countries" is reassuring, preserving economic lifelines like the Iran-Pakistan gas pipeline (delayed but vital for Pakistan's energy security). Joint border patrols under the 2019 MoU persist, though the pact might divert Pakistani resources—e.g., diverting FC (Frontier Corps) units from anti-smuggling ops to Persian Gulf deployments.

Open-source indicators reveal keen interest from several nations in acceding to this framework, potentially evolving it into a multilateral shield. The UAE, with its Mirage 2000-9 fleet and ambitions for a "Persian Gulf NATO," tops the list—Abu Dhabi's prior defense MoUs with Pakistan (including pilot training) align seamlessly, and sources suggest imminent talks for integration.

Qatar, despite Al Udeid's US basing, eyes the pact for diversified deterrence post-2022 blockade scars, with indications of exploratory discussions. Egypt emerges as a likely candidate: Cairo's Sisi administration seeks Saudi funding for its T-90MS MBTs and could contribute expeditionary forces, as noted in geopolitical analyses.

Bahrain and Jordan, already in Saudi-led coalitions, have expressed interest via diplomatic channels, bolstering maritime interdiction in the Strait of Hormuz. Even Oman, traditionally neutral, monitors developments for selective engagement in counter-piracy ops.

Mohammad Molaei is a Tehran-based military affairs analyst.

(The views expressed in this article do not necessarily reflect those of Press TV)

VIDEO | The Venezuela Operation

Cuba condemns 'hostile' US rhetoric, pledges to defend sovereignty

Key Mossad operative executed over transfer of sensitive Iran info

Israeli presence a ‘legitimate target’ as minister visits Somaliland: Yemen

VIDEO | Assassination of two key figures in fight against US-backed Daesh

VIDEO | Press TV's news headlines

VIDEO | Gaza hospitals without life-saving devices amid Israeli restrictions

VIDEO | Austrian FM says ‘EU too weak to uphold international law’

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website