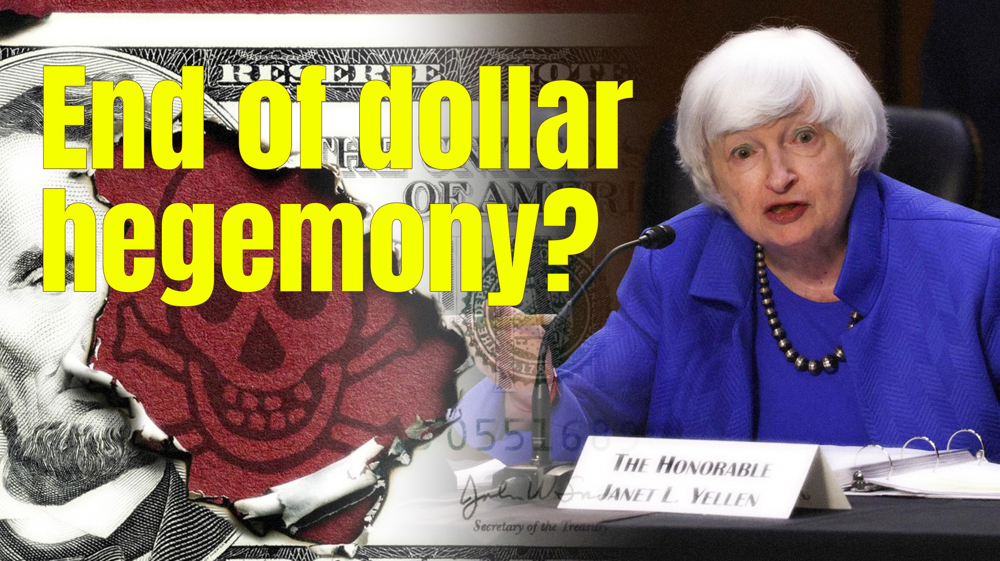

Demise of dollar: India, Bangladesh join hands to ditch US currency in cross-border trade

India has finally joined hands with Bangladesh to do cross-border trade in their own currencies, the Indian rupee (INR) and the Bangladeshi taka (BDT), making Bangladesh the nineteenth country to ditch the US dollar.

After months of intense discussions and meetings, a delegation from the Reserve Bank of India (RBI) and the State Bank of India (SBI) visited Dhaka to discuss and finalize the mechanism to engage in cross-border trade in local currencies.

In order to set into motion the initiative, two of Bangladesh’s banks, Sonali Bank and Eastern Bank Limited, are expected to open accounts in two Indian banks, the State Bank of India and ICICI Bank.

The two Indian banks are also going to do the same by opening similar accounts with two Bangladeshi banks, according to news reports.

The opening of these accounts, known as vostro and nostro accounts in global accounting, will require the approval of respective central banks, according to bank officials.

Out of the total worth of Indian exports to Bangladesh, $2 billion worth of the exports are set to be traded in INR, and the rest would be paid in US dollars. Meanwhile, exports from Bangladesh to India will be fully traded in rupee and taka, according to Indian media.

The two friendly neighbors will do cross-border trade in rupee and taka without the inclusion of any third currency and hence would benefit from abandoning the dollar exchange process.

"Bilateral trade with India in taka and rupee will reduce pressure on the US dollar. Both countries will benefit from this," Md Afzal Karim, CEO, and managing director of Sonali Bank Limited, was quoted as saying by The Business Standard.

Karim said more banks from the two countries will gradually join the process. However, not all bilateral trade will be in local currencies.

Bangladesh Bank executive director and spokesperson Md Mezbaul Haque said that the decision has been welcomed by businesses in his country to settle trade with India in INR and BDT, as “they think that the arrangement will promote trade and reduce pressure on forex reserves.”

Before Bangladesh, countries like Russia, Germany, the United Kingdom, Singapore, Sri Lanka, Oman, and 12 other countries are already trading with India in local Indian currency INR.

India has emerged as one of the international players to push up the trend of de-dollarization globally, and has over time accelerated its foreign trade with other countries in the rupee.

In 2022, India launched its own rupee trade settlement mechanism, allowing countries that don't have enough dollars or cannot trade in dollars to trade in rupees.

Previously, in early April, India signed an agreement with Malaysia that allows the bilateral trade to be settled in Indian rupees.

Last week, world-renowned economist Nouriel Roubini hinted that the Indian rupee over time could become one of the global reserve currencies in the world.

“One can see how the rupiah (INR) could become for some of the trade that India does with the rest of the world, especially South-South trade could become a vehicle currency,” Roubini, nicknamed as ‘Doctor Doom’ by Wall Street, said in an interview with ETNow news channel.

“It (Indian rupee) could be a unit of account, it could be a means of payment, it could become a store of value. Certainly, the rupiah (rupee) over time could become one of the varieties of global reserve currencies in the world,” the economist noted.

Turning tables

Earlier in April, the New Development Bank (NDB), established by the BRICS group, decided to move away from the US dollar in international trade, as it aims to introduce local currencies for its loans.

In a bold move that has turned tables in geopolitics, NDB President Dilma Rousseff confirmed that the bank plans to provide 30 percent of loans in local currencies of its member nations, effectively moving away from using the US dollar in international trade.

“It is necessary to find ways to avoid foreign exchange risk and other issues such as being dependent on a single currency, such as the US dollar,” Rousseff said during an interview on April 14 with Chinese media outlet CGTN.

BRICS nations are in the early stages of designing and adapting a new currency, which aims to end the global dominance of the American bill.

The BRICS nations were also reported of buying a massive amount of gold, in a move to increase their reserves, and ahead of a plan to dethrone the US dollar, The Daily Hodl reported.

The US will suffer devastating hyperinflation and war starvation as the BRICS decides to dump the dollar, according to Robert Kiyosaki, author of Rich Dad Poor Dad.

The BRICS group constitutes the economically-aligned fastest-growing economies that would collectively dominate the global economy by 2050, i.e., Brazil, Russia, India, China, and South Africa.

Iran along with other countries, including Saudi Arabia, has formally applied to join the extended BRICS+ group.

Iran has also abandoned dollar trade with China and Russia. Saudi Arabia, a key OPEC member, said it will completely give up PetroDollar and will start accepting PetroYuan.

More countries than ever are taking part in the global movement of dumping the dollar, a trend that has become malignant against the US, and economists believe that the de-dollarization process is inevitable.

The US hegemony and the practice of illegally sanctioning other countries have accelerated the loss of confidence in the dollar, and hence the de-dollarization trend has emerged as an act of dissent among developing nations against the US.

Iran sees no limits in defending itself after Leader's ‘dangerous’ assassination: FM

IRGC strikes USS Abraham Lincoln aircraft carrier with volley of ballistic missiles

Iranian armed forces to pulverize US bases across the region: Pezeshkian

Enemy will take dream of enslaving the Iranian nation to grave: Army chief

IRGC launches largest barrage of missile strikes at Israeli occupied territories

Assassination of Ayatollah Khamenei ‘open war against Muslims’: Pezeshkian

Iranians rally countrywide to mourn Leader’s martyrdom in US-Israeli aggression

Qalibaf to US, Israel: We will deal such painful blows that you will beg for mercy

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website