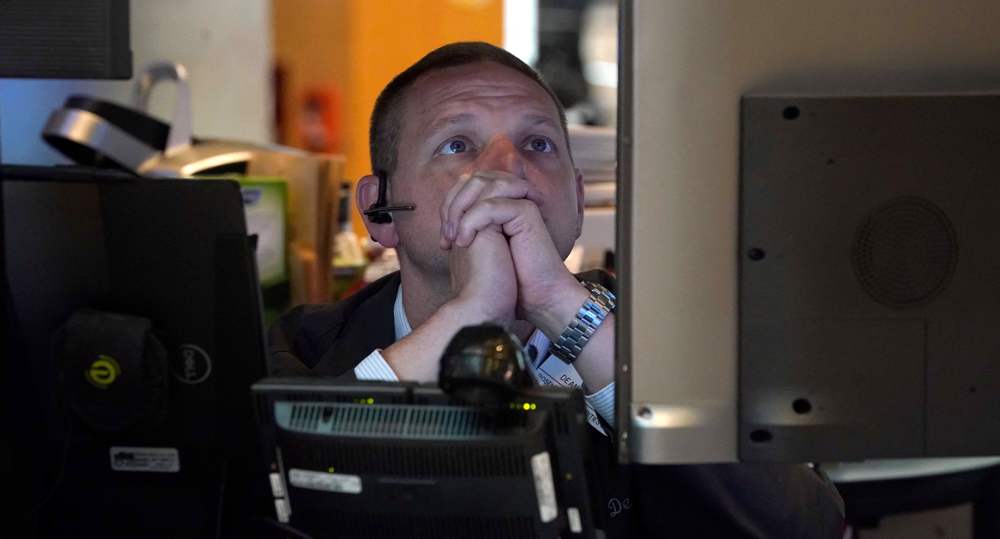

US stocks fall as Fed seen hiking after good jobs data

Wall Street stocks fell early Friday following unexpectedly strong US jobs report that boosted the odds of further aggressive interest rate hikes by the Federal Reserve to cool the economy.

The US economy added 528,000 jobs in July, far above expectations, while the unemployment rate dipped to the pre-pandemic low of 3.5 percent, Labor Department data showed.

But while strong hiring is an unmistakable indicator of economic robustness, investors interpreted the report as likely to lead to more big moves by the Fed after the US central bank enacted two straight 75 basis point interest rate increases.

Equity market strength since the Fed's July 27 meeting has been partly based on expectations that the US central bank could "pivot" to a more moderate stance.

"The key takeaway from the report is that it squashes the friendly notion that the Fed can turn friendly with its monetary policy decisions sooner rather than later," said Briefing.com analyst Patrick O'Hare.

About 25 minutes into trading, the Dow Jones Industrial Average was down 0.3 percent at 32,629.38.

The broad-based S&P 500 fell 0.6 percent to 4,128.91, while the tech-rich Nasdaq Composite Index dropped 1.0 percent to 12,595.27.

Among individual companies, Warner Brothers Discovery plunged more than 15 percent after reporting a $3.4 billion loss, much of it due to merger-related costs.

(Source: AFP)

True Promise 4: Iran and resistance axis ops. against US-Israeli assets on Mar. 9

Top official: Iran ready for a long war with US, no more diplomacy

Ansarullah leader felicitates Iranians on election of new Islamic Revolution leader

IRGC Navy: We have 2 'defining' weeks ahead

Hezbollah launches rocket attack on Israeli soldiers near Lebanon border

Europe’s Islamic student union pledges allegiance to Ayatollah Mojtaba Khamenei

Global economic fallout from the US-Israeli war on Iran deepens

No security in Strait of Hormuz amid US-Israeli war on Iran: Top security official

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website