Investors, court deliver ‘stark warning for Big Oil’ on climate

The oil industry, long a political heavyweight in Washington, received a series of major blows on Wednesday after shareholders, customers and the courts turned on the industry due to concern over climate change.

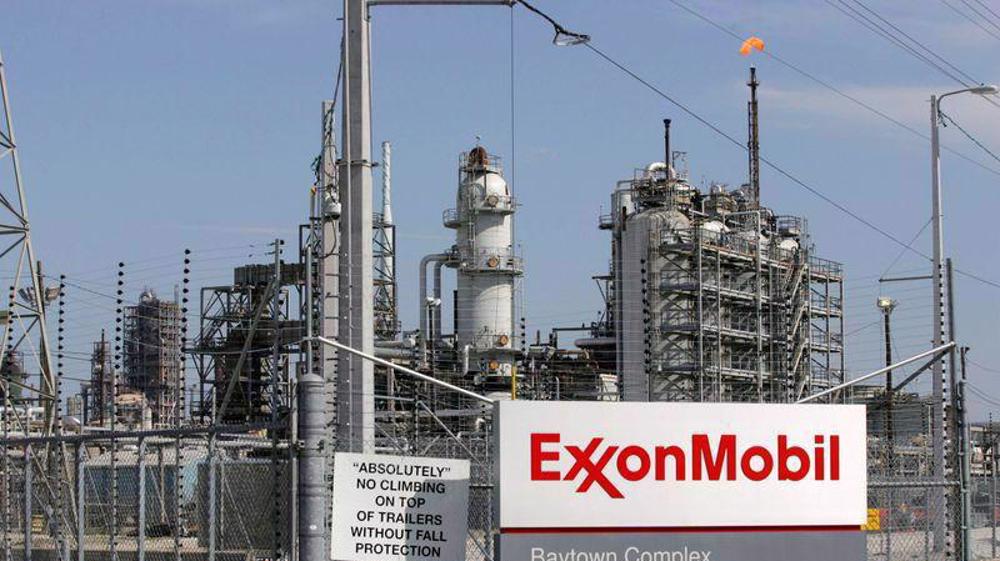

While Exxon Mobil Corporation, an American multinational oil and gas corporation headquartered in Irving, Texas, was bested by an upstart shareholder seeking to shake up the firm’s board, investors in Chevron Corporation, another American multinational energy corporation in San Ramon, California, instructed the company to cut its greenhouse gas emissions.

In what appears to be a stunning blow to top management at Exxon, the company lost at least two board seats to activist hedge fund, Engine No. 1.

At Chevron, just over two-thirds of the firm’s investors supported a resolution for the company to cut emissions from the end-use of its fuels with 61% supporting the call. Another resolution calling for a report on the business impact of achieving net zero emissions by 2050 was supported by 48% of votes cast.

In addition, a Dutch court ruled Wednesday Royal Dutch Shell, a British-Dutch multinational oil and gas company headquartered in The Hague, Netherlands, needs to accelerate cuts to greenhouse gas emissions.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZKFUKDVELNPT5HSSXVSFGOIPDU.jpg)

Judge Larisa Alwin ordered the company to cut its carbon emissions by almost half by 2030 from 2019 levels.

"The court orders Royal Dutch Shell, by means of its corporate policy, to reduce its CO2 emissions by 45 per cent by 2030 with respect to the level of 2019 for the Shell group and the suppliers and customers of the group."

"Today was a stark warning for Big Oil," said Bess Joffe, of the Church Commissioners for England, which manages the Church of England's investment fund, with executives "being held to account by investors and lawmakers."

“Game-changer is an overused metaphor, but surely this is one,” Environmental Defense Fund President Fred Krupp said of Wednesday’s events. “The policy environment for companies has already changed and will change more.”

Investor support for climate concerns could force oil and gas companies to rethink how fast they pivot to other forms of energy.

"The question for oil companies is when and how much" do they cut oil and gas production in response to investor and social concerns, said Charles Elson, a professor of corporate governance at the University of Delaware.

The votes show a new sense of urgency, according to Mark Van Baal, who leads a climate advocacy group that placed resolutions calling for emissions cuts at Chevron, ConocoPhillips and Phillips66. All received at least 58% support.

Investors say, “We want you to act by decreasing emissions now, not in the distant future,” he said.

Meanwhile, Dan Gocher from investor advisory group, the Australasian Centre for Corporate Responsibility said Wednesday’s developments put the oil and gas industry on notice.

"This news is nothing short of extraordinary, and it will have massive implications for the Australian oil and gas industry.

"Chevron, Exxon Mobil and Shell are three of Australia's largest oil and gas producers, and therefore three of our largest carbon polluters.

"All three companies will now be under enormous pressure from both shareholders and the wider public to cut emissions, and cut them fast."

IRGC Navy pounds US MST ship with a volley of missiles after Israeli-US aggression

Iran’s retaliatory attacks will continue uninterruptedly: Senior commander

Saudi Arabia lobbied for UAE sanctions: Trump

IRGC launches missile, drone strikes against Israel in response to US-Israeli aggression

IRGC pounds US bases across West Asia following US, Israeli aggression

VIDEO | Plan for US-pegged digital currency in Gaza raises sovereignty fears

OIC welcomes Oman-mediated Geneva talks between Iran, US; warns against use of force

VIDEO | Campaign to boycott Israeli ‘apartheid dates’ in UK intensifies during Ramadan

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website