Global trade war would hurt US the most: Report

A fierce global trade war would significantly hurt the economy of the United States, making households poorer and destroying jobs, while China would not suffer as much, according to a new report by the European Central Bank.

Stock and bond markets could also be hurt by a general loss of confidence in the economy, ECB economists said in research published Wednesday.

"An escalation of trade tensions could have significant adverse global effects" on US economic growth, the authors said.

One particular conclusion by the study was that the country starting the trade war would wind up worse off than before.

“Qualitatively, the results are unambiguous: an economy imposing a tariff which prompts retaliation by other countries is clearly worse off. Its living standards fall and jobs are lost," the report said.

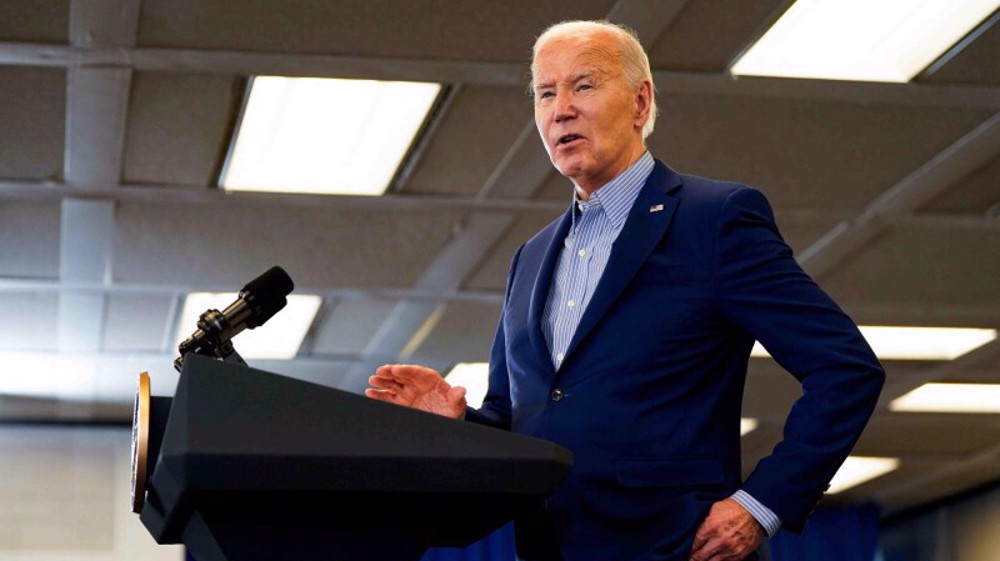

US President Donald Trump has imposed tariffs on imported steel and aluminum, and on a range of Chinese goods, carrying through on his election campaign rhetoric.

His stated goal is to protect US companies and workers from what he sees as unfair trade, and to use the tariffs as a lever to push for new trade arrangement.

The ECB study' authors, however, said those initial measures should have only "marginal" effects on the global economy because the goods affected represent a small part of global trade.

Trump on Monday announced 10 percent tariffs on $200 billion worth of Chinese goods and China slapped $60 billion in retaliatory tariffs on US goods. The American tariffs would rise to 25 percent in January.

Trump threatened last week to add $267 billion in Chinese imports to the target list. That would cover nearly everything China sells to the United States.

The researchers used computer models developed by the International Monetary Fund and the ECB itself. They ran a scenario in which the United States slaps a 10 percent tariff on all imports and all trade partners respond in kind.

That scenario is only hypothetical, they said, but the results were significant. It indicated a 2 percent loss in economic growth in the first year for the United States, and a 3 percent drop in global trade.

The point of the exercise was to indicate the general direction of what would happen to the economy if tariffs spread.

Higher tariffs would have both positive and negative effects for the country imposing them. Consumers would face higher costs as the prices of imported goods reflect the higher tariffs. On the other hand, they might turn to domestically produced goods, boosting their nation’s economy.

However, the models found that the negative effects outweighed the positive: "Lower US imports and gains in market shares by US producers in their home market are outweighed by lower exports."

The US would import fewer Chinese goods, but the effect on China would be cushioned by diverting those products to other export markets: "In China, the trade effect on GDP is initially slightly positive, although the gains diminish over time."

Chinese companies have diversified their export markets and added more complex products such as bulldozers and power transformers, making its exports more resilient.

US vetoes Palestinian request for full UN membership

Iran sufficed to striking part of Israel’s military positions: FM to UN chief

IRGC: Israel’s Dimnoa nuclear reactor not among Op. True Promise’s targets

'Stop any further Israeli adventurism,' Iran FM tells Security Council

Google fires 28 employees for protesting military deal with Israel

Burkina Faso expels three French diplomats over ‘subversive activities’

Iran slams G7 statement, vows no iota of doubt to respond to aggression

German authorities arrest Jewish activist over pro-Palestinian demos

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website