Iran to open largest flare gas refinery soon: Zangeneh

Iran will soon bring online its biggest refinery for processing gas associated with oil production, built with $3 billion of investment, Minister of Petroleum Bijan Zangeneh says.

The Persian Gulf Bid Boland Gas Refinery in Behbahan will become operational early next Iranian year which begins on March 21 and is expected to be “the source of a major change in reducing environmental pollution and developing the petrochemical industry”, he told a national TV program Tuesday night.

Gas in oil fields is often intentionally burnt off in a practice known as flaring in order to make way for oil production. Not only are tremendous quantities of gas wasted, but one percent of the global greenhouse gas is also emitted in the process.

US sanctions imposed after President Donald Trump’s withdrawal from a landmark nuclear deal in May 2018 have been preventing Iran from importing equipment needed to stop environmental pollution, in what Zangeneh has already denounced as “a crime against humanity”.

The US is among the top four flarers of gas in the world along with Russia, Iraq and Iran, but the problem is expected to get worse in the United State where shale drilling is growing at breakneck speed under the Trump administration.

The bulk of Iran’s gas flaring occurs at southern oil fields, where a pall of gray smog often hangs over the horizon. In 2018, Zangeneh said that Iran needed $5 billion to curb flaring of gas on its oil fields.

Before the US sanctions, Iran got several offers for the recovery of flare gas. The National Iranian Oil Company (NIOC) even signed a faring contract with France’s Sofregaz.

French developers also offered to purchase associated gas from Forouzan offshore oil field which Iran shares with Saudi Arabia in the Persian Gulf and convert it into LNG. But, none of the plans materialized after the US reimposition of sanctions because foreign companies withdrew from Iran.

The pullout, instead, allowed Iranian companies to take up the slack.

Zangeneh said on Tuesday night that the nearly-finished Persian Gulf Bid Boland Gas Refinery has a capacity to process 56 million cubic meters a day of associated gas, enough to produce 3.5 million tonnes of feedstock for use in petrochemical plants in Khuzestan province.

“This will usher in a major change in developing the petrochemical industry in Khuzestan province, especially the Gachsaran region,” the minister said.

More flare gas projects underway

Zangeneh said two more contracts have been signed with Persian Gulf Petrochemical Industries Co. and Maroon Petrochemical Co. to collect and process flaring gas from East Karoun oil fields.

Another project for processing associated gas from West Karoun oil fields - NGL 3200 plant for natural gas liquids – is under construction, which he hoped will come on stream in the current administration.

Furthermore, the construction of the Dehloran gas refinery known as NGL 3100 has reached 40 percent of physical progress and the project is expected to finish in the next two years, Zangeneh said.

In the offshore sector, Iran has carried out two projects to process associated gas from Siri and Qeshm oil fields in the Persian Gulf.

“The only remaining project is to collect associated gas from the Kharg oil field which is also on our agenda,” the minister said.

Iran sits on the world's largest reserves of gas and the fourth largest oil deposits just behind Venezuela, Saudi Arabia and Canada, but the development of its energy sector has been bedeviled by sanctions.

Officials say the country’s priority for now is to develop joint fields. Iran shares the world’s largest gas field with Qatar in the Persian Gulf. While Qatar was the world's largest exporter of liquefied natural gas (LNG) until a year before, Iran has yet to carve out a niche in the market.

For now, Iran’s only major gas customers are Turkey and Iraq. Zangeneh said Iraq currently has an outstanding debt of $2 billion to Iran for imports of gas. “It seems some accounts have recently been opened for its repayment,” he added.

Last week, an Iranian official said Iran’s money from exports of gas and electricity had piled up to $5 billion in a bank account in Iraq, but Tehran could not transfer it because of the US sanctions.

Iran has overtaken Qatar in South Pars

Zangeneh said Iran has overtaken Qatar in recovering gas from South Pars, which is being vacuumed up at a “high speed”. This pace of discharge means production is about to decline soon, he added.

“In South Pars, we had a very splendid performance, where our production rose from 280 million cubic meters in 2014 to 670 million cubic meters this year, which is 2.4 times higher,” he said.

However, Iran is well behind Qatar in exploiting the South Pars oil layer - about 25,000 barrels a day against 300,000 barrels being produced by the tiny Arab country.

NIOC once approached Denmark’s Maersk to develop its side of the layer, but negotiations did not firm up to a contract.

Last January, media reports said Iran was in talks with several domestic companies to extract more oil from South Pars. However, they need modern technologies, including for horizontal drilling, which only a few international companies possess.

In other joint fields, a degree of stabilization has been achieved, Zangeneh said, adding production from oil fields shared with Iraq has increased five-fold since 2014.

Chinese pull out of Yadavaran

Yadavaran and Azadegan are the two major reservoirs in the West Karoun block, which extend into the Iraqi soil.

Chinese companies have brought the fields to production and were shortlisted to carry out further development, but Zangeneh said they were not continuing work in Yadavaran.

“We are now developing a plan to develop the field, but before its implementation, we will talk to the Chinese side again so that there will be no room for legal claims later. Also in Azadegan, we have signed a contract with a general contractor and want to proceed in this format,” he added.

China National Petroleum Corp (CNPC) last year joined France’s Total to abandon the development of South Pars.

Zangeneh said the development of Phase 11, which the two companies were supposed to carry out, “is in progress with the cooperation of Iranian company Petropars and we hope to have the initial production from the phase by the end” of the current administration in May 2021.

Last year, reports said state-run Chinese energy giant Sinopec had offered Iran a $3-billion deal on further development of Yadavaran.

The deal offered by China would double production at Yadavaran to more than 200,000 barrels a day (bpd) within six months, the Wall Street Journal reported then.

The paper said the Chinese believed the offer wouldn’t violate a US ban on signing new development deals with Iran because the Yadavaran contract went back to 2007.

Yadavaran was launched with a production of up to 115,000 bpd and around $2 billion of investment by Sinopec in November 2016. CNPC brought online the first phase of North Azadegan with 75,000 bpd in early 2017.

Palestinian shepherds suffocating as Israeli settlers steal more lands: Report

Palestine women’s team scripts history with 1st game in Europe on Nakba Day

Raeisi: Iran-Azerbaijan ties stronger than mere neighbors

'Israel must be held accountable for crimes against Palestinian athletes'

1948 Nakba remembrance in London

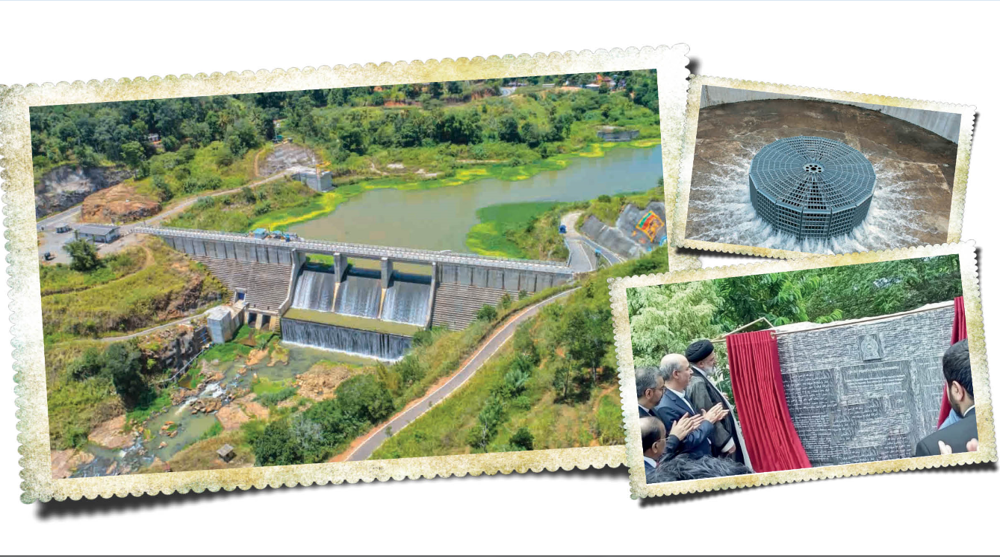

Iranian, Azerbaijani presidents inaugurate Qiz Qalasi border dam

VIDEO | Press TV's news headlines

Iran provides free healthcare to children under 7 despite sanctions

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website