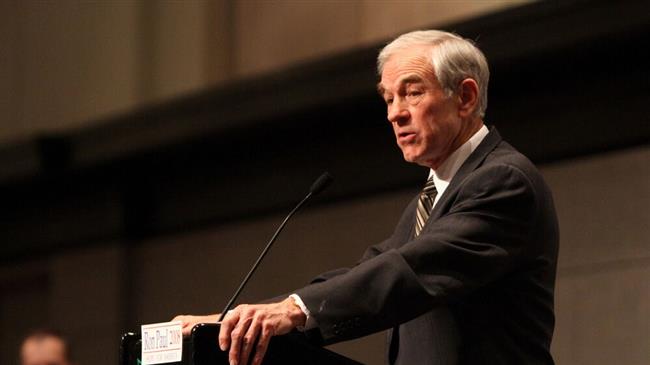

Former congressman Ron Paul predicts ‘big bust’ for US economy

Former Republican congressman and presidential candidate Ron Paul has warned that rising interest rates and a housing bubble are negative factors for the US economy which will lead to a “big bust.”

Paul, the founder of the Ron Paul Institute for Peace and Prosperity, made the remarks in a recent interview with Hill.TV on Thursday.

“I would say on a general appearance, it’s pretty good – regulations are down, and taxes are down but I give him more credit, which is pseudo-credit in that he’s a great cheerleader and there is such a thing as subjectivity in cheerleading in the economy – people do respond in a positive way,” he said.

"But the economy on the surface is good, but it’s not sound, it’s not lasting, it’s based on debt and the payment will come due soon,” he added.

“I have a feeling we might not make it to the end of the year before you see the markets sending a much stronger signal,” he pointed out.

Dr. Paul said this will eventually lead up to a “big bust,” adding that it’s not a matter of if there will be a massive correction but rather a matter of when.

"Right now we are at the tail end of one of the biggest, massive monetary inflation in history of mankind,” said Paul, who has maintained strong positions against the military-industrial complex and the Federal Reserve, each of which he considers responsible for many of the ills afflicting the United States.

The basic source of the economic trouble is America’s central banking system, known as the Federal Reserve or the Fed, which cannot function in a real market economy, he said.

The liquidation of America’s fourth-largest investment bank, Lehman Brothers, in September 2008 almost brought down the global financial system. The collapse triggered an international economic crisis, which is considered by many economists as the worst financial crisis since the Great Depression of the 1930s.

The crisis played a significant role in a downturn in global economic activity that led to the 2008–2012 global recession and contributed to the ongoing European sovereign-debt crisis.

The effects of the 2008 financial crisis are still being felt in the United States and across the world. According to the Atlanta Federal Reserve's GDPNow, the American economy will grow only 0.9 percent in the third quarter.

VIDEO | UK govt. Rwanda bill denounced as 'state-sponsored people trafficking'

VIDEO | Iran president visits Lahore, Pakistan’s cultural hub

North Korea: US military drills drive regional security into turmoil

UN agency chief for Palestinians urges probe into staff killings

200 days of Israeli war on Gaza and 200 headlines whitewashing genocide

VIDEO | 200 days of US-Israeli genocide

Iran’s security chief in Russia to underline Israel’s aggression

VIDEO | Smoke rises from Gaza as fighting continues

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website