US Senate approves major tax overhaul, despite deficit warnings

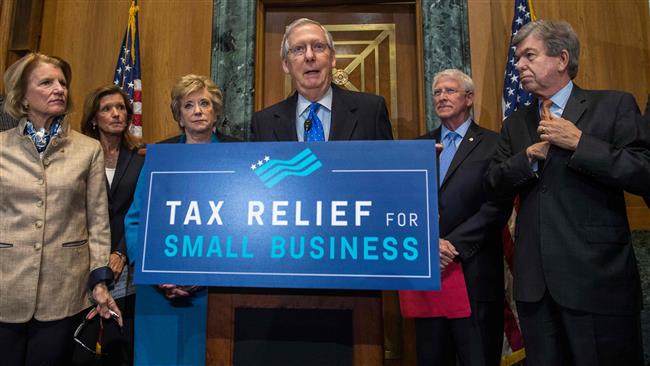

The US Senate in Congress has approved a sweeping tax overhaul that will offer huge tax cuts for US corporations and the wealthiest Americans and likely increase the budget deficit by $1 trillion in a decade.

The upper chamber of Congress voted 51 to 49 on Saturday in favor of the nation's largest tax overhaul in 31 years, delivering Republicans and President Donald Trump a major legislative victory.

Republicans, who are the majority in the US Senate, rallied around the tax bill on Friday, giving the sweeping legislation sufficient votes to win passage.

The Senate version of the bill and one passed earlier this month by the House of Representatives must now be reconciled into a single bill, and approved again by both chambers.

The single bill must then go to the White House, where Trump was expected to sign it into law before the end of the year.

Under the bill, the corporate tax rate would be permanently slashed to 20 percent from 35 percent, while future foreign profits of US-based firms would be largely exempted from tax.

Senator Bob Corker, a leading deficit hawk who pledged early to oppose any legislation that expanded the budget deficit, was the lone Republican dissenter.

“I am not able to cast aside my fiscal concerns and vote for legislation that ... could deepen the debt burden on future generations,” said Corker, who is not running for re-election.

In Senate speeches, Democratic Party lawmakers attacked the legislation as a giveaway to the wealthy and large corporations that will expand the massive deficit, but the Democrats lacked the votes to block it.

The broad-based US tax cuts proposed by the Trump administration in September would mostly benefit the very wealthy while adding $2.4 trillion to the budget deficit over 10 years, according to an analysis by the Tax Policy Center.

The majority of economic research suggests that most of the benefits of corporate tax cuts end up flowing to shareholders through stock buybacks or increased dividends and do not increase the pay of ordinary workers.

Most economists agree that the Republican tax plan will boost business investments, but say it’s unrealistic to expect the kind of investment windfall that proponents of the tax plan argue will prompt employers to raise wages.

The White House Council of Economic Advisers promises that the corporate tax cuts would boost the US economy and offset the deficit.

But the Joint Committee on Taxation, a committee of the US Congress, said Thursday the tax overhaul would add $1 trillion to the deficit, even after accounting for expected economic growth from the plan.

Opposition has grown among Americans to the Republican tax plan. A Reuters/Ipsos poll released on Wednesday shows that 49 percent of people who were aware of the measure say they opposed it, up from 41 percent in October.

VIDEO | Islamabad rejects US report on rights practices in Pakistan

VIDEO | Yemenis endorse naval forces' attacks on Israeli-linked ships

VIDEO | New national transport strike hits Italy

US to pull out troops from Chad in second African state withdrawal

Yemeni armed forces strike British oil tanker in Red Sea

VIDEO | Genocide in Gaza

VIDEO | Press TV's news headlines

VIDEO | American, Israeli rabbis call for ceasefire during protest near Gaza

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website